2021 New Years Resolution

- Project Equity

2021 New Year’s resolution: Create a succession plan

New Year’s resolutions are important for us to refocus and prepare for a new year. As a business owner, it’s important to be prepared for the future. And, sometimes, that means succession planning. We spoke with Stephen Simmons, the founder and CEO of Umpire about how he waited too long to get his succession plan underway.

Forget the mistake, remember the lesson

Stephen Simmons is the founder and CEO of Umpire, a growing company, which provides services to get homeowners back to normal following a flood, fire or mold event. Simmons did not always run Umpire.

For 30 years, he ran a mitigation business started by his father through a franchise license. In 2007, the ownership of his franchise license transferred from a corporate structure to private equity. From that day forward, everything changed (and not in the best of ways) — including how job leads were distributed, how direct revenue was shared, and increased local competition from the franchise.

When he owned the franchise business, Simmons knew that he would sell it someday, as it had become apparent over time that no one in his family would take it over. So, he’s always kept an eye open for opportunities to sell his successful business down the road. And he certainly tried. But, its structure as a franchise created obstacles. Simmons shared, “When I found buyers interested in purchasing my business, I had to get them approved by the corporate franchise. Then, instead of buying my business, the corporate franchise sold my buyers a new franchise license.”

He began researching employee ownership as an option. He knew his employees knew how to run the business. “I had people who have earned it and should benefit from it. Plus, emotionally, it would make me feel good,” asserted Simmons.

Simmons started his discovery phase by discussing employee ownership options with his CPA. “They were not pro-employee ownership,” he said. “They thought it was not protecting me, and that I could get a higher price if I sold it back to the corporate franchise or to an outside individual. But, because, at the time, the corporate franchise was not purchasing local franchises, my options were limited.”

Stephen researched the benefits of employee ownership and how it would affect his business, his employees and his family. Ultimately, though, Stephen listened to the counsel of his CPA and did not sell his successful business to his employees. If instead, he had made the transition to employee ownership, his family’s legacy business would still be in operation.

If Stephen had made the transition to employee ownership, his family’s legacy business would still be in operation.

The changes the private equity firm implemented to the franchise made his business unprofitable. The support he had received in the past was no longer there. The private equity owners developed a growth strategy that increased competition and focused on selling new franchises, while the established franchises faltered. As a result, what was once a successful family business became an ignored investment. Unfortunately, a legal fight ensued, and Stephen ultimately lost the franchise license and filed for business bankruptcy.

Planning to succeed

Running a business is hard work. Most business owners find themselves too absorbed in the business to work on longer-term needs like planning for succession. The daily work needed to make a business successful seemingly leaves no time to plan for the ownership and management changes that will inevitably occur.

Running a business is hard work. Most business owners find themselves too absorbed in the business to work on longer-term needs like planning for succession. The daily work needed to make a business successful seemingly leaves no time to plan for the ownership and management changes that will inevitably occur.

When planning for succession, several tough personal issues surface such as, “What will I do when I retire?” These issues are often more complex when there are no clear successors in place.

Business owners should ideally start to develop a plan five years before selling their business.

Most experts suggest starting to develop a plan five years before selling your business, or worst case, at least a couple of years in advance. Visier, a company that identifies opportunities and risks within organizations, suggests integrating management succession planning into the business strategy to gain the ability to see when and where replacements will be required. More importantly, you get to align current opportunities in the company within future plans, and with the development and growth needs of your most important talent – your succession candidates.

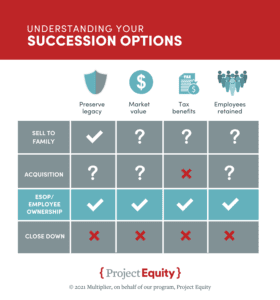

According to BizBuySell, the largest online marketplace for businesses, only 20% of businesses listed for sale ever sell. We clearly need more strategies for local business succession to avoid unnecessary closures due to lack of planning. The good news is that not only is employee ownership viable for many companies, it provides similar benefits to family ownership, and it helps business owners “find a buyer right under their nose.”

Article details

Audience

Topic

Not applicable